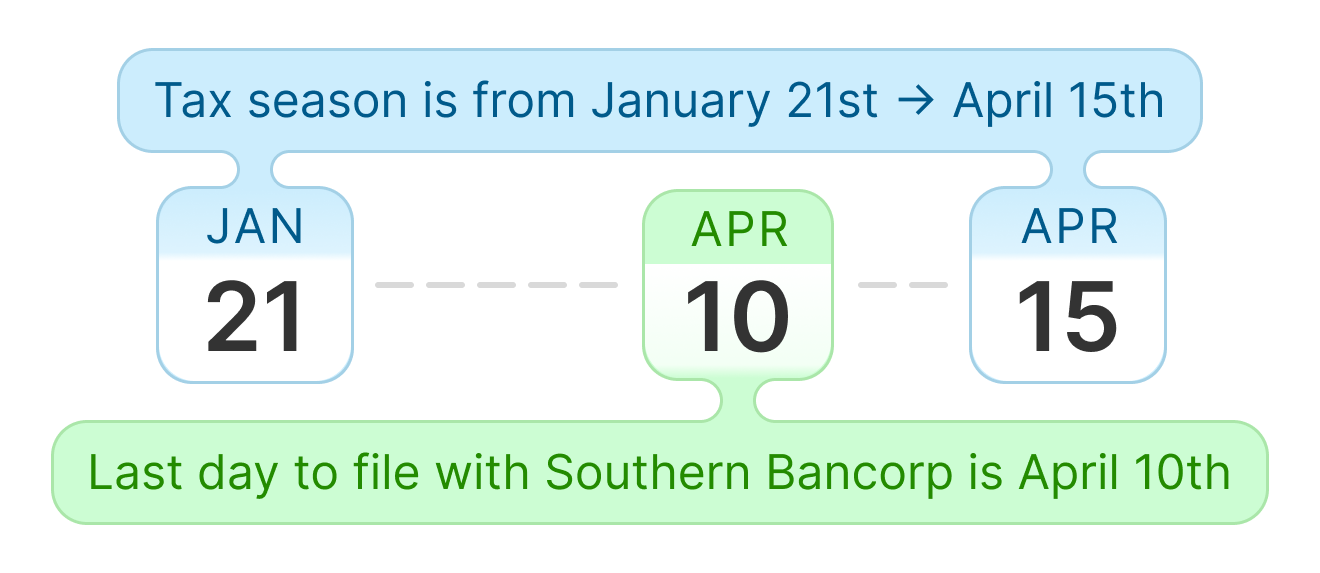

January 21st -> April 10th

Get your taxes

done by a certified

tax preparer.

For Free.

Every Tuesday and Thursday* during tax season, Southern Bancorp will offer Free Tax Services at 47 locations across Arkansas and Mississippi.

Jonesboro Tuesdays only*

100% FREE

No hidden fees!

ZERO STRESS

Now offering drop off and virtual assistance!

OPEN TO THE PUBLIC

With annual income of $67K or less

How it works

Stop by a location

Drop off documents

Your taxes are prepared & filed

When is this happening?

What to bring

Photo ID

Driver’s license, State ID, etc.

Proof of Other Deductions

Bank records, written acknowledgments, etc.

Proof of Charitable or Church Contributions

Bank records, written acknowledgments, etc.

Income Documents

1099, W-2, Pay Stubs, etc.

Proof of Marketplace Healthcare Coverage

This comes in the form of the 1095-A document.

Social Security Card or ITIN

The physical document is required.

Free Tax Prep & More

For Record Sealing in Arkansas, be sure to start the ACIC Report process 2-3 weeks in advance. Learn more

Clarksdale, MS

Southern Bancorp

875 S State St, Clarksdale, MS 38614 | 9AM - 12PM

Tax Preparation

Free

Meal

Helena-West Helena, AR

Southern Bancorp,

425 Plaza, West Helena, AR 72390 | 9AM - 12PM

Tax Preparation

Free

Meal

Made Possible By

Participating Branches

Enter your location (address or zip code) to find the branch nearest you.

Arkansas

Arkadelphia • 601 Main St

Arkadelphia • 2500 Pine St

Barton • 6011 U.S. Highway 49

Bismark • 6764 Arkansas 7

Blytheville • 1040 E Main St

Blytheville • 120 S 2nd St

Blytheville • 807 N 6th St

DeWitt • 220 West Cross St

El Dorado • 1615 W Hillsboro St

El Dorado • 2421 NW Ave

Elaine • 128 Main St

Eudora • 2943 S Hwy 65

Glenwood • 218 Elm St

Gurdon • 600 E Main St

Hamburg • 210 N Main St

Helena-West Helena • 502 Cherry St

Helena-West Helena • 425 E Plaza St

Helena-West Helena • 432 Sebastian St

Hot Springs • 206 Airport Rd

Hot Springs • 4138 Central Ave

Hot Springs • 2212 Malvern Ave Ste 1

Jonesboro* • 2508 E Highland Dr

(Jonesboro only preparing taxes on Tuesdays)

Little Rock • 3999 W 12th St

Lockesburg • 103 W Main St

Malvern • 208 Ash St

Manila • State Hwy 18 East

Marvell • 911 Hwy 49

Marion • 205 Block St

Mount Ida • 506 Highway 270 E

Stuttgart • 620 E. 22nd Street

Trumann • 362 Highway 463 N

West Memphis • 1103 N Missouri St

Mississippi

Canton • 648 E Peace St.

Carriere (Picayune) • 9 E Lakeshore Dr

Clarksdale • 875 South State St

Drew • 108 Main St

Greenville • 1686 Mississippi 1

Greenville • 215 S Broadway St

Hattiesburg • 3002 Hardy St, Ste 100

Hernando • 970 Byhalia Rd

Indianola • 507 Highway 82 East

Leland • 323 Hwy 82 E

Madison • 1888 Main St Ste D

Mound Bayou • 202 Edward Ave

Olive Branch • 5218 Goodman Rd, Ste 101

Ruleville • 117 W Floyce St

Webb • 2058 US-49E

If you don’t live in or near one of these areas listed above, please visit the IRS website or MyFreeTaxes.com to find a VITA site near you or call 1.800.829.1040.

Have more questions?

Contact us at (800) 789-3428 or online below:

Made possible by

Little Rock, AR

Saturday from 10:00 AM - 4:00 PM

Goodwill Center

7400 Scott Hamilton Dr, Little Rock, AR

Se Habla Espanol

Habrá voluntarios de impuestos en el lugar para ayudar a aquellos que hablan español.

Tax Preparation

Taxes will be prepared for free by IRS certified volunteers.

Legal Services

Health Screenings

Screenings provided

- Blood Pressure

- Hepatitis

- Cholesterol

- Blood Glucose

- HIV

Thank you to our Healthcare Sponsors

Clarksdale, MS

Saturday from 10:00 AM - 4:00 PM

Clarksdale Civic Auditorium

506 E 2nd St Clarksdale, MS

Tax Preparation

Taxes will be prepared for free by IRS certified volunteers.

Eudora, AR

Saturday from 10:00 AM - 4:00 PM

J Austin White Cultural Center

160 S Main Street Eudora, AR

Tax Preparation

Taxes will be prepared for free by IRS certified volunteers.

Legal Services

Health Screenings

Canton, MS

Saturday from 10:00 AM - 4:00 PM

Canton Multipurpose & Equine Center

501 Soldier Colony Rd, Canton, MS

Se Habla Espanol

Habrá voluntarios de impuestos en el lugar para ayudar a aquellos que hablan español.

Tax Preparation

Taxes will be prepared for free by IRS certified volunteers.

Legal Services

Health Screenings

Helena-West Helena, AR

Saturday from 10:00 AM - 4:00 PM

Southern Bancorp

425 E Plaza Ave West Helena, AR

Tax Preparation

Taxes will be prepared for free by IRS certified volunteers.

Legal Services

Health Screenings

Jonesboro, AR

Saturday from 10:00 AM - 4:00 PM

St. Bernards Auditorium

505 E Washington Ave, Jonesboro, AR

Se Habla Espanol

Habrá voluntarios de impuestos en el lugar para ayudar a aquellos que hablan español.

Tax Preparation

Taxes will be prepared for free by IRS certified volunteers.

Legal Services

Health Screenings

Clarksdale, MS

Saturday from 9:00 AM - 12:00 PM

Southern Bancorp

875 S State St, Clarksdale, MS 38614

Tax Preparation

Taxes will be prepared for free by IRS certified volunteers.

Free Meal

Complete your taxes and receive a FREE meal on us! Don't miss out on this tasty deal! Free meal offer valid only for those who get their taxes done.